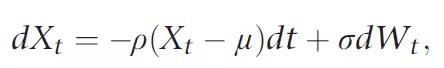

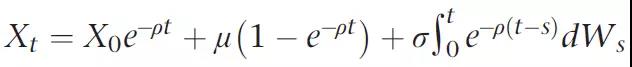

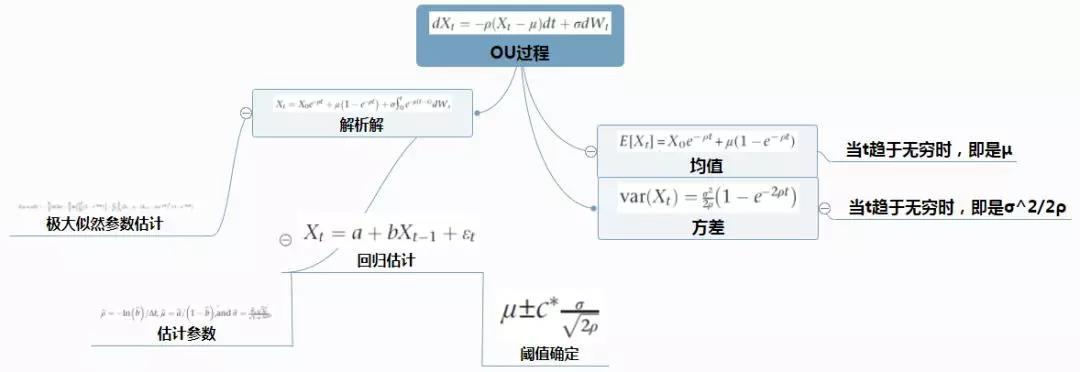

In pairs trading, the dynamics of the spread is often assumed to follow a meanreverting OU process given by (Elliot et al. 2005; Avellaneda and Lee 2010):

where ρ is the speed of mean reversion,Wt is the standard Brownian motion, and μ is the long-term equilibrium level of the spread. The solution of Equation is given by

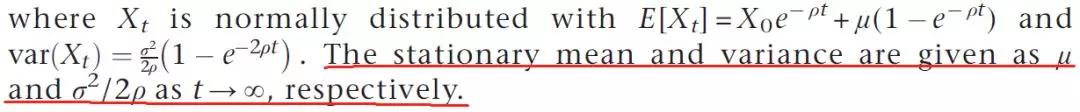

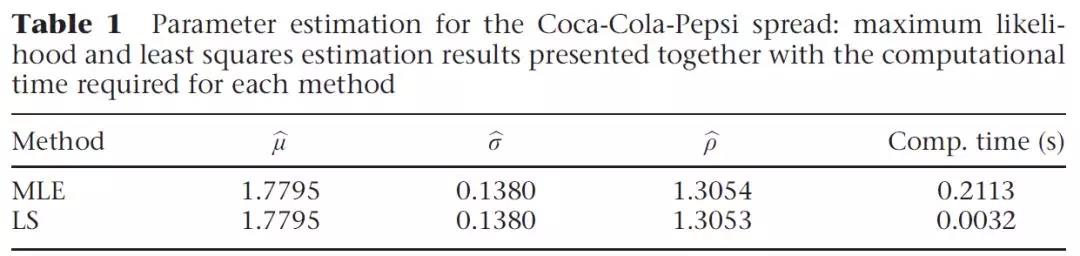

In Table 1. We observe that the LS and the MLE methods give very close results with very different computational speeds.Note that the MLE method uses an optimization algorithm that requires the gradient vector for the parameter space search, and thus, optimization algorithm is much slower compared with the matrix operations needed in obtaining the LS estimates. Therefore, for real trading applications, we suggest the least squares estimation for model calibration.

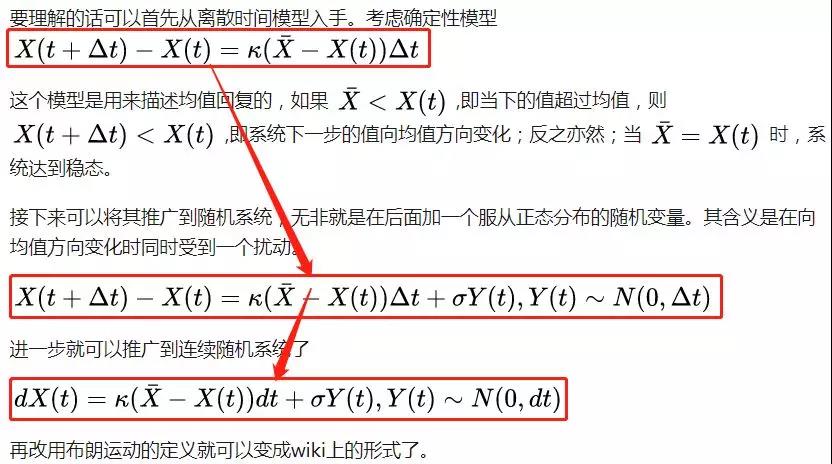

下面给出知乎中liu mohan的精彩解释:

相关推荐: